Tesla Q1 Earnings: Robotaxi in 2024, Cybertruck in 2023, Record profit

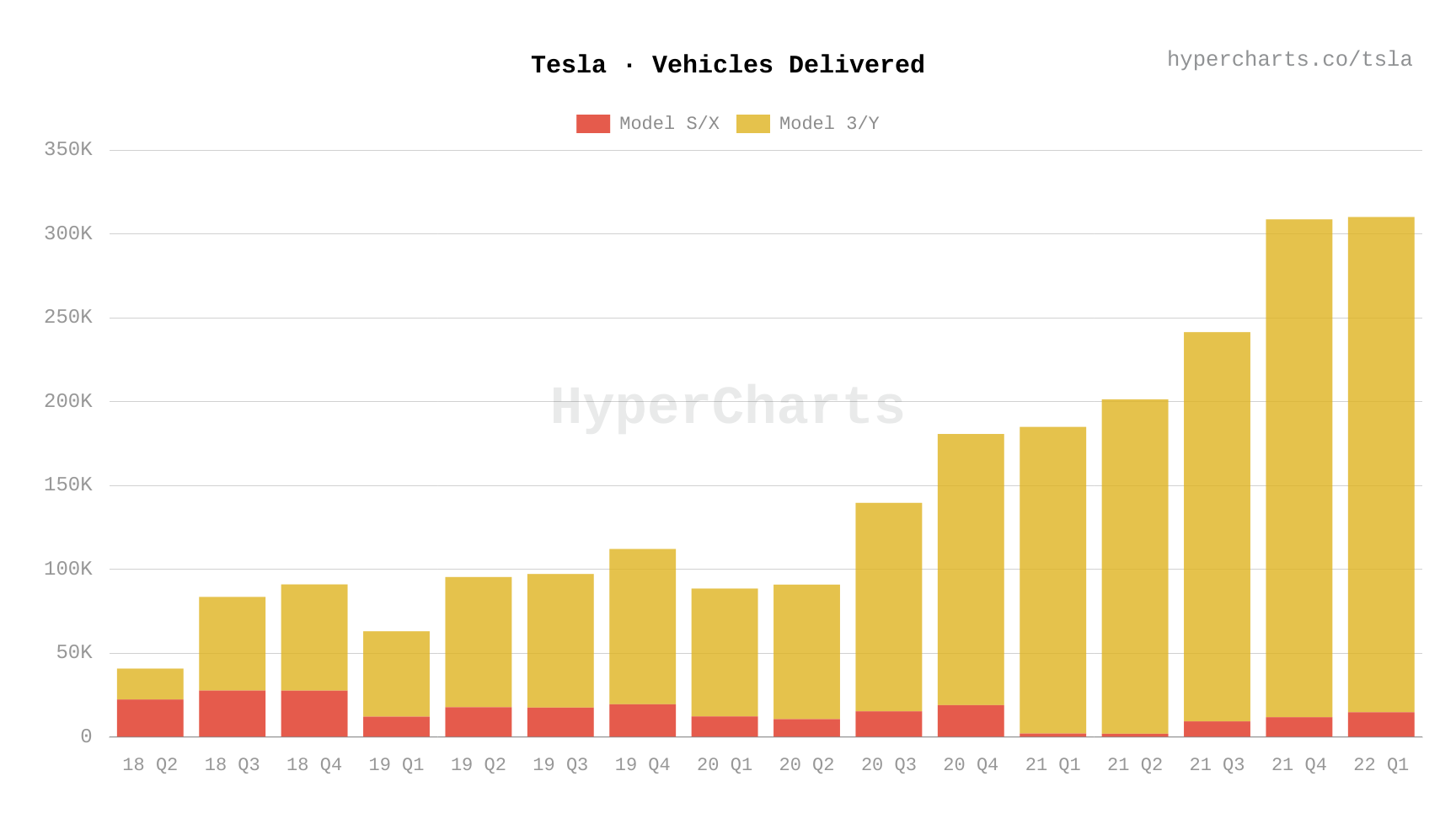

Financial Results

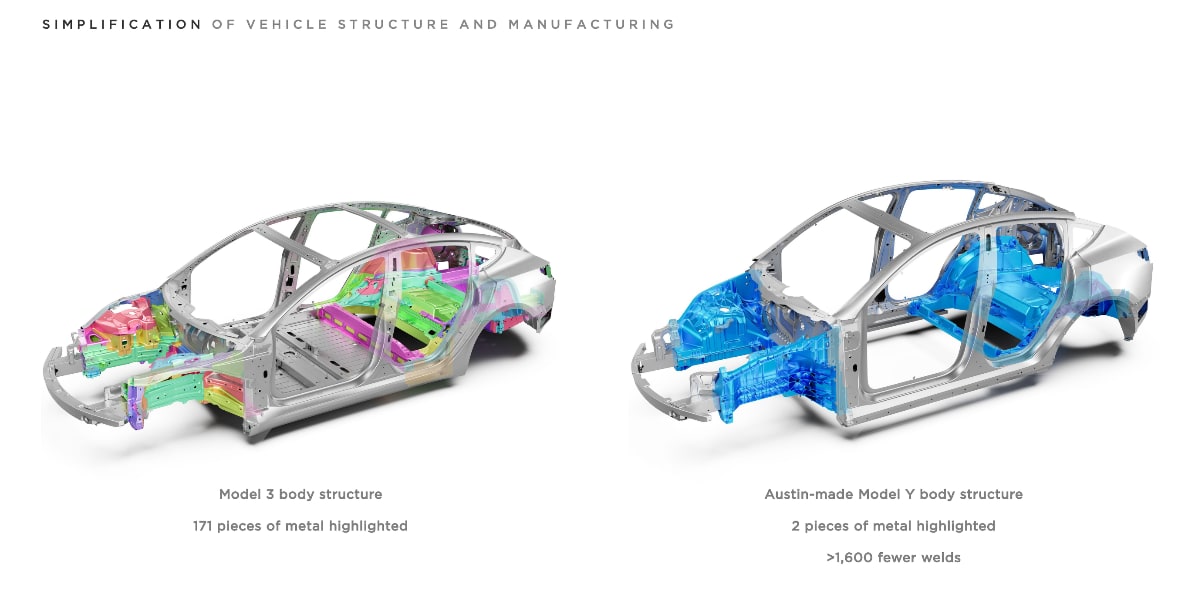

Tesla just reported first-quarter results for 2022 and beat analysts' expectations on the top and bottom lines. Despite factory shutdowns, inflationary pressures and semiconductor chip shortages, the automaker delivered 310,000 vehicles, up 81% YoY.

Revenue also rose 81% to $18.6 billion from $10.39 billion a year ago, thanks to higher average car prices and increased vehicle sales, the company said.

For the period ending March 31, 2022, Tesla reported $3.22 earnings per share. Since posting a record profit, shares have risen as much as 6% in after-hours trading.

Challenges This Quarter

In its letter to investors, Tesla said supply-chain problems and raw-material prices costs have increased “multiple-fold”.

"Our own factories have been running below capacity for several quarters,” Tesla said in its shareholder deck. The company did not give detailed guidance on deliveries going forward, but said it expects 50% annual growth on a multi-year basis, and warned that supply chain constraints are likely to continue through 2022."

Tesla said that a spike in COVID-19 cases caused a temporary shutdown of the Shanghai factory and shortages in the company’s supply chain.

“Although limited production has recently restarted, we continue to monitor the situation closely,” the company said.

The ramp-up in the newer Texas and Berlin gigafactories will also depend on supply-chain obstacles, Tesla said.

“Factory ramps take time, and Gigafactory Austin and Gigafactory Berlin-Brandenburg will be no different.”

The company also stated it would release its Full-Self Driving to all U.S. customers that opted for the $12,000 package “before the end of this year.”

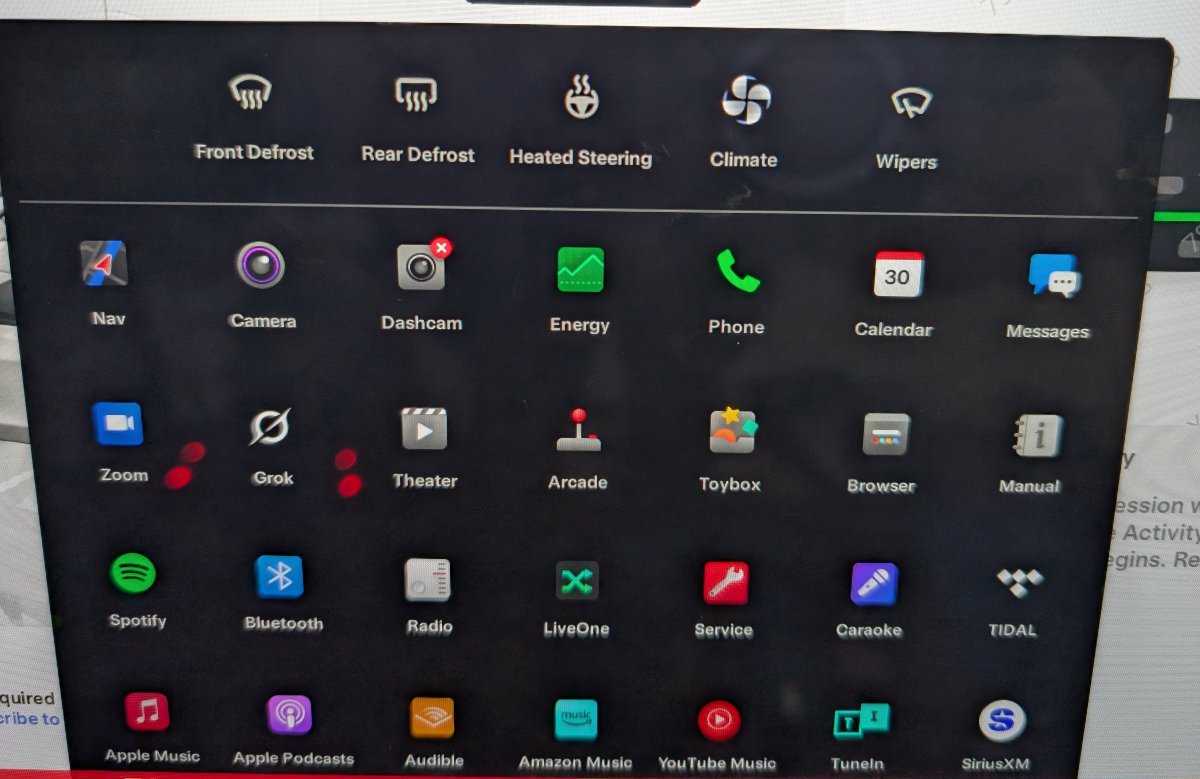

Energy

Tesla’s solar deployments dropped by 50% YoY to 48 MW this past quarter. The company deployed 846 MWh of battery storage systems, up 90% YoY, but down from the previous quarter. The company said declines in solar deployments were caused by supply chain constraints on certain components.

Insurance

Tesla says they are the 2nd largest insurer of Teslas in the state of Texas, and could be the largest by the end of next quarter. Tesla is now a fully integrated provider of insurance in the states (list of states) where they have released their insurance product.

Cybertruck and Robotaxi

On the earnings call, Elon confirmed Cybertruck production to begin in 2023 and a vehicle built for autonomy, without a steering wheel or pedals to be produced in 2024 which would be "a massive driver of Tesla's growth."

Elon also reiterated his stance on Tesla's optimus robot, saying that it has more potential opportunity than the car business over time.

When asked about raw materials and scaling to extreme size, Elon stated that Lithium mining is the limiting factor to production. He later said that "Tesla will likely need to help the industry on this."

When asked about the future of EV affordability, Elon stated that the robotaxi will provide the lowest cost per mile of transport ever, a 5x-10x reduction, making it accessible to everyone. Based on their projections, it appears that a robo taxi will cost less than a subsidized bus/subway ticket.

Earnings Overview

Twitter user @DBurkland put together this overview of everything that was discussed during the earnings call.

Opening remarks from Zach Kirkhorn

- Per unit vehicle costs increased due to inflation, raw material costs, and supply chain constraints

- Slight shift towards more profitable vehicles like the Model Y

- Energy business continues to be impacted by macro conditions more than vehicle business (chip constraints)

- Achieved record operating margin over 19% amidst construction of 2 new factories (Giga Berlin & Giga Texas)

- Tesla has reduced debt (excluding product debt) to nearly 0

- Lost 1 month of build volume lost due to COVID-related shutdowns at Giga Shanghai (will dramatically affect Q2 delivery numbers)

- Inefficiencies of ramping process at Giga Berlin & Texas will affect bottom line

- Tesla still believes 50% YoY growth w/ vehicle production in 2022 is still achievable

Opening remarks from Elon Musk

- Record deliveries and production even with many headwinds

- Even with COVID shutdowns in Giga Shanghai Elon believes they still have a shot at 60% YoY growth for 2022

- Two new factories opened in Q1 and exponentially ramping (Giga Berlin & Giga Texas) with higher production volumes achievable by end of this year

- Just crossed 1m units in the last year however long way to go as Tesla aspires to produce 20m units per year (only 5% towards their goal)

- Elon never more excited for Tesla and their future then he is now

- Robotaxi

- Highly optimized for autonomy (no steering wheel or pedals)

- Numerous other innovations

- Fundamentally optimized for lowest fully considered cost per mile, accounting for everything (very powerful product)

- Expect to reach volume production of Robotaxi in 2024

- CyberTruck

- On track for volume production in 2023

- Optimus

- Elon surprised people weren’t more excited for this but he thinks folks will fully understand its capabilities & impact will be greater than FSD or vehicle businesses

- Energy

- Battery & solar production will improve as supply chain issues are resolved

Q&A

FSD Development Progress

- Elon has never seen more false dawns than with the development of FSD. Real world AI has to be solved for (nobody has solved yet) and with our roads designed for humans, NNs & cameras have to be solved in a way that is on-par with (and exceeds) the capabilities of humans. Elon still believes they will deliver on FSD in 2022. Best way to realize this is participate in FSD beta program and experience it for ourselves as they’ll be expanding the program later this year. Still targeting new FSD release cadence of every 2 weeks.

Giga Shanghai Shutdown

- Production is coming back with a vengeance and Elon expects weekly production records to be broken as they work to catch up. Still possible to match / exceed Q1 numbers however Q3 & Q4 are expected to be record quarters in terms of production. Elon believes Tesla will easily be able to produce 1.5m vehicles this year.

- It’s important for new factories to target limited configurations during ramp and that is why both Giga Berlin & Giga Texas are hyper-focused on producing the Model Y.

- Ramp period (5k per week) takes typically 9-12 months from start of production however it’s possible for Tesla to ramp sooner based on their experience.

Price Increase

- Elon says it is understandable that there are many folks questioning price increases especially amidst record profitability however the price increases are there to account for an increase in raw materials costs and potential supply chain constraints in the future (since vehicle deliveries are a year out).

State-based Dealership Laws

- Tesla would love federal-based laws that allows direct sales across the country however congress is not willing to take up this sort of legislation at this time (so Tesla is approaching it on a state-by-state basis)

800V Battery Architecture

- Tesla is not ignoring the reality that they can go to a higher voltage however there is not any compelling reason to change at this point

- Going from 400V to 800V might save them $100 per vehicle (however requires changing all of the backend infrastructure)

- Switching to 800V might make sense down the road however Tesla needs to increase vehicle volume to absorb the cost of moving from 400V to 800V first

- For larger vehicles where higher power on the battery side and/or charging side is required

(where current requirements go up), savings can be seen by increasing voltage as it would reduce

semiconductor needs (and thus save $)

- Tesla is considering different voltages for CyberTruck and Semi

- For 3, Y, and Robotaxi they see no need to switch

4680 Batteries

- Tesla is working in all areas that they described during the battery day event and making good progress

- Going to take several years to achieve the cost savings and performance numbers they described during battery day

- 4680 structural pack will be competitive with the best alternatives later this year and exceed the best alternatives next year

- New chemistries hinted at however will be included in 4680 production later on

- Based on Giga Texas factory construction, the 4680 production equipment cost 5x less than what

it would have been with other battery cell designs

- Cost model well understood, rate and yield will be better understood as they ramp over next few years

- Giga Berlin will transition to 4680s from 2170s later this year

- Giga Texas has the capability to produce non-structural pack for 2170s (mitigation)

- Volume production for 4680s in Giga Texas targeted by end of Q3, for sure Q4

- Sizable cell inventory thanks to Giga Shanghai shutdown and allows them to be more deliberate in 4680 development (gives them some breathing room during ramp)

- 4680 production not a risk to achieving vehicle production target in 2022 however would be in 2023

Raw Materials Required To Scale

- Tesla needs to think about tonnage of Nickel, Iron Phosphate, Graphite, Separators, Electrolytes for the world as a whole

- Then take action on limiting factors that get in the way of the advent of a sustainable energy future

- Tesla is thinking about mining & refining Lithium is a current limiting factor and responsible for cost growth per cell as of late (single biggest on a percentage basis)

- Lithium only makes up only 2-3% of a Li-Ion cell (5kg per car)

- Cathode (Nickel & Iron Phosphate) is the heaviest in terms of cost and raw materials composition of a battery cell

- Exciting announcements on the raw materials topic in the months to come, Elon hinted to a follow up call / event

- Tesla committed to recycling at all cell factories, recycling 50T per week in Reno (ramping to 150T) which is putting materials right back into their Cathode supply chain

- As they are building new vehicles at new factories, Tesla is recycling everything they can from a raw materials perspective

- Tesla figured out they can recycle cast aluminum wheels from retired ICE cars and throw it into their aluminum melting pot and use for vehicle body production for 3 & Y

- Half of Tesla’s products were LFP-based in Q1 2022 which shows how nimble they are regarding

battery chemistry

- Also looking at other cathode options to give Tesla further agility

- Some of the challenges with Lithium market are not related to supply & demand fundamentals (frustrating to Tesla)

Giga Berlin & Texas Ramping related to Giga Shanghai

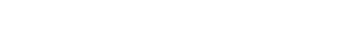

- Elon thinks they need to ramp Berlin & Texas faster than Shanghai as they are more experienced now and have learned so much in the simplification of Model Y production

- Body line for front & rear cast underbody + structural pack is 60% smaller than it would be otherwise in terms of equipment required

- If you are waiting for the best Tesla ever you will be waiting forever as they are constantly improving

Robotaxi

- Unveiling event sometime next year, Elon doesn’t want to go into too many details until then

- Volume production in 2024

- Sizable investment required to build robotaxi production lines

Prices Over Time

- Elon wants to make EVs as affordable as possible however this has become very difficult due to inflation (40-50yr high)

- Likely to continue for remainder of 2022

- Long term contracts with suppliers have helped Tesla keep costs down longer than expected but eventually they run out

- 20-30% cost increase from suppliers over last year which is why Tesla has raised their prices

- Lithium margins are practically software margins right now (Elon encouraging more to get into this business)

CyberTruck

- Ignoring battery cells Tesla believes the CyberTruck is made of 20-30% less parts than a typical pickup truck

Giga Nevada

- Room for expansion there and the plan is to expand production at Giga Nevada further

- Majority of battery cells will be produced at Giga Texas going forward

COVID Shutdowns in China

- Elon doesn’t think recent COVID shutdowns in China will negatively impact production elsewhere

Elon compensation

- No plans or talks to increase Elon’s compensation further

3rd Party Access to Supercharger Network in USA

- Tesla plans to provide 3rd party vehicle access to the entire world and remains committed to that

- Tesla is pursuing a technical solution to address the difference in charging connector in the US (magic dock)

- Growth of Supercharger network is being accelerated to match increase in vehicle production

Tesla Insurance

- In state of Texas Tesla is the second largest insurer of Teslas and should be #1 in the next quarter

- Working to get 80% of states access to Tesla insurance by end of year at which point they’ll look to expand to other markets

- Having realtime feedback for driving habits (safety score program) is proving helpful to Tesla owners w/ Tesla insurance as it directly relates to a lower rate

- When a crash happens it gives Tesla a new feedback loop to improve vehicle design, reduce costs, etc (End-to-end visibility)

You can also find outlines from previous earnings calls on his website DBurkland.com.

![Tesla Autonomously Delivers Its First Vehicle to Customer — And It’s More Impressive Than Expected [VIDEO]](https://www.notateslaapp.com/img/containers/article_images/model-y-2025/newmodely_77.jpg/382e0312c769d0bb2e1234f7ac556fad/newmodely_77.jpg)