Tesla Shares New Details on FSD Unsupervised, Robotaxi, Potential FSD Price Hike During Q1 2025 Earnings Call

In case you missed Tesla’s Q1 2025 earnings call last night, or just want to see the cliff notes, we’ve got you fully covered. While Tesla called this event a “Company Update” on their Investor Relations website, we covered all the usual aspects of a regular earnings call.

Tesla had a rough Q1, but managed to pull through even in the face of one of the most financially difficult quarters in recent memory. There’s also a lot of exciting news as Tesla shared updates and key information on some of its upcoming products.

Tesla actually started this event relatively on time, with the call beginning just seven minutes after the scheduled start time. If you prefer to listen to the call, you can listen below with the call starting at the 7 minute, 9 second mark.

FSD Supervised & Unsupervised

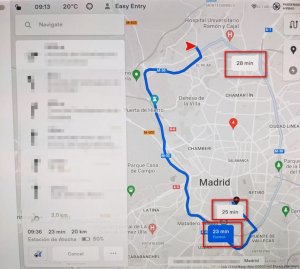

FSD Supervised launched in China, received positive reception.

Tesla launched FSD in China without access to country-specific data, and it is performing extremely well.

They expect this will make it easier to launch elsewhere.

FSD Supervised for Europe still on track for 2025.

FSD Unsupervised is now running Model 3, Model Y, and Cybertrucks from the production line to the outbound logistics lots at Fremont and Giga texas.

As of this quarter, FSD has been driving people in North America and China for 7.7 Million miles per day.

Tesla will consider pricing options for Unsupervised FSD vs Supervised FSD

In the meantime, Tesla plans to gradually lighten the supervision requirements

Executive team believes FSD is too cheap at $99/mo as it currently stands

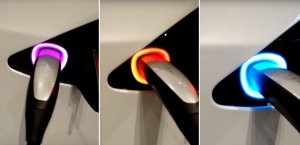

Glare, Sand, Dust, Fog

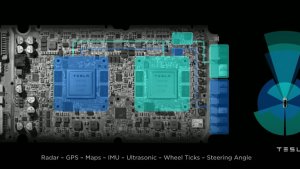

Cameras are not fully blinded by glare or other obstacles

Tesla’s photon-count analysis happens before digital signal processing - the image you see on the dash may be washed out, but FSD can see fine.

Snow and Inclement Weather

These are still a challenge for scaling out to areas that experience snow.

Tesla is looking at implementing localized parameters to deal with snow or other localized conditions in the future

Not essential, but a “nice-to-have”

These parameters will be focused on improving reliability for certain tasks, like driving in snow

Waymo

Tesla doesn’t see Waymo as a challenger

LIDAR is expensive, can’t solve many problems

Pure vision is the key (along with audio now)

Tesla isn’t just doing a software solution and attaching hardware to a pre-existing vehicle, Tesla is building the vehicles ground-up with autonomy in mind

Validation is still a challenge, due to edge cases.

QA fleet is driving in Austin, and can go many days without an intervention

Difficult to tell whether improving or regressing

Deeper and broader simulation systems are being built

Seeing an intervention every 10,000 miles means they need 10,000 miles of data on average to address it

Need as much data as possible - 10,000 miles is the average distance covered by a driver in North America in a year

The executive team noted that Chinese FSD testers are doing a fantastic job testing edge cases

Unsupervised FSD & Robotaxi Fleet

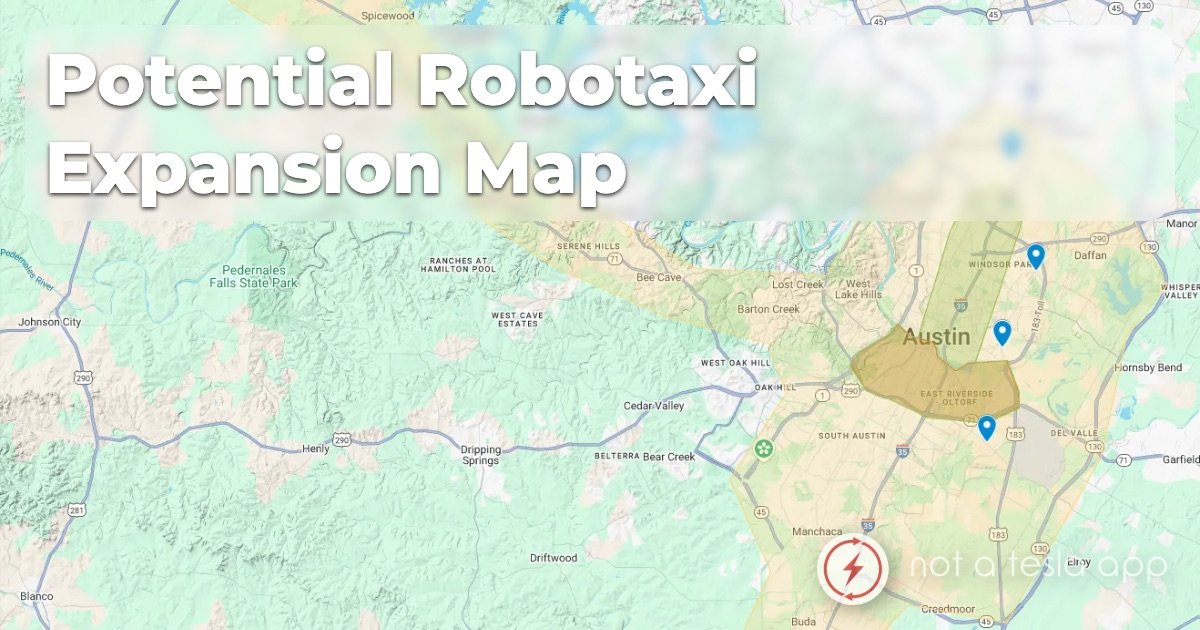

Tesla is on track for the pilot launch of Robotaxi in Austin for June 2025.

These will move the financial needle in the 2nd half of 2026.

The first vehicles will be Model Y’s, not Cybercabs.

Aim is to start in Austin and roll out elsewhere in the United States by the end of the year

Focus is to ramp quickly, and have millions of vehicles operating autonomously by the end of 2026.

Remote Support for robotaxi fleet could happen, not 100%

10-20 vehicles on Day 1 for Robotaxi fleet

Scale-up will happen slowly

By the end of June or early July, anyone will be able to go to Austin and use a robotaxi

Vast majority of Tesla’s existing fleet will be capable of Unsupervised FSD

Elon specifically mentioned the Model S, 3, X, and Y

This is the fourth event (We, Robot, Q4 Earnings 2024, All-Hands, and Q1 Earnings 2025) without mention of the Cybertruck being capable, likely meaning that FSD development for the Cybertruck is further behind as we’ve seen.

Tesla’s generalized solution to autonomy means that once they verify it works in a few North American locations, it should work in any North American city

Key limitation is regulatory approvals

This also applies for other areas of the world - the generalized solution will make it easy to apply it elsewhere

Tesla is providing autonomous supervised vehicles today that are capable of:

Cutting commute effort

Improving lives for customers with disabilities

Tesla’s executive team wants to get these stories out and get people to experience FSD

Unsupervised FSD should launch for customers in the US, ideally by end of year

Safety is a key concern, Tesla needs to continue reducing interventions per mile

Tesla will be careful with rolling this out outside of dedicated fleets

It must be meaningfully (10x or more, as per Q4 2024) safer than a human

Will likely be geofenced to specific cities or locations

Elon expects the first Model Y will drive itself from Fremont or Giga Texas all the way to a customer by the end of 2025

Affordable Vehicle

The plan for the new more affordable model (identified as a new vehicle), remains on schedule for production beginning in the first half of 2025.

These will utilize aspects of the next-generation platform as well as current platforms, and be produced on the same manufacturing lines as current vehicles.

This approach will result in less cost reduction, but will enable Tesla to manage capital expenditures.

This model will start production as soon as June and be in the market shortly thereafter.

Ramping will be slower than hoped due to global tariff and financial impacts

Production timeline is still on track overall

Tesla is aiming for a lower initial cost of ownership and lower monthly payments

Tesla will use its existing lines - reducing the overall form factor difference between this new model and what Tesla already exists

Likely based on the Model 3 or Model Y

Will resemble the overall form and shape

Cybercab

Cybercab will use the unboxed manufacturing strategy, and is scheduled for volume production in 2026.

Sample production validation is ongoing now

First builds will happen near the end of Q2

Production is on-schedule at Giga Texas

No new building is being built, it will be built inside already planned space

Unboxed method is progressing well

It is the basis for the Cybercab’s manufacturing process

It lowers the cost of production and increases the level of automation considerably

Tesla is working on marrying large assemblies together, fixing vehicle ceiling connections, and recently completed corrosion testing

Unboxed methodology will eventually be incorporated into other lines

Cybertruck is already benefiting from some aspects of this method

Long term goal is a 5 second cycle time for Cybercab

Giga Shanghai currently has a 33 second cycle team for Model Y

Current Vehicles

Giga Texas produced its 400,00th vehicle in April, and Tesla launched the Cybertruck Long Range (RWD).

Giga Nevada achieved record battery pack production this quarter.

Model 3 and Model Y deliveries in the US (and Canada) are now made with 100% US-built battery packs.

Tesla achieved record orders in a single day in the Asia-Pacific region with the launch of the Refreshed Model Y.

This is the most competitive region for EVs, and a validation of Tesla’s cost structure and positioning.

Giga Berlin built its 500,000th Model Y this quarter.

Tesla has officially opened the first overseas market for the Cybertruck - Saudi Arabia.

Q1 is historically the worst quarter for auto sales, and the best quarter to do production swaps

Tesla used this as an opportunity to do the swap at all 4 factories around the world at the same time

Never been done before - especially as 1.1 million Model Y’s are built per year globally.

Optimus

Tesla’s Fremont factory is preparing production for the Optimus pilot line for 2025, and wider deployments of Optimus for internal Tesla use is expected this year.

There has been good progress on finalizing Optimus so far, still in prototyping stages

Tesla expects its pilot production line to begin running near the end of 2025

Several thousand units should be working in Tesla’s factories by the end of the year

Optimus ramp will be challenging, lots of new and unique components Tesla doesn’t make already

Optimus will use the AI4 computer

Shoulder actuators use permanent/rare earth magnets

Working with China to get a license for use

Goal is 1 million units per year by 2030

Batteries

The 4680 Cell (Cybercell) is IRA-complaint and eligible for the US Federal EV Rebate.

It is the lowest cost-per-kWh cell.

Tesla has diversified and protected the supply chain, and each component for the 4680 is sourced from at least two countries.

Lowest cost cell of any cell available on the market right now

Easy to build a flashy product that does one thing (e.g. charging fast) well, but difficult to scale it up and be profitable

Tesla’s lithium refining and cathode production plans will start production in 2025, moving critical battery production to the US.

Will be the biggest lithium refinery outside of China, and could potentially expand to be the biggest.

Cathode production will also make a big impact

Anode production or removing anodes entirely is being worked on

Tesla is no longer supply constrained for vehicle batteries, but is constrained on LFP batteries for North America due to tariffs.

Supply Chain

Tesla is continuing to localize supply chains where possible

Makes sense from a cost and logistics risk standpoint

Supply chains should be located on the continent of which the vehicle is built

Tesla is the least impacted car company in respect to tariffs

Places Tesla in a stronger position than their competitors

Elon believes in lower tariffs, and advocates for them

Tesla will be impacted by the May tariffs due to part production in Canada and Mexico, no way around this right now

Tesla has to buy equipment from outside the US and import it - it is expensive to bring in equipment from China

China has the most capacity to provide this equipment

Tesla is working to on-shore production of LFP, as most Tesla Energy batteries are supplied from China

There is an outsized tariff impact on Tesla Energy at the current time, and Tesla is looking at non-China suppliers of Lithium

Tesla is continuing to focus on adapting to policy changes

85% of US-built vehicles have North American content

95% of Asia-Pacific vehicles have Asian-Pacific content

Vertical integration and local partnerships are the key to increasing these

Tariff risks are higher for low-volume platforms (S, X, Cybertruck)

Tesla can bridge and cover production for other regions in times of crisis

Tesla is building strategic banks of parts they cannot vertically integrate, such as processors and microelectronics

Tesla is working to reduce or stop the reliance on rare earth magnets as much as possible

Energy

There was a 154% increase in energy storage deployed YoY, for a total of 10.4GWh.

Tesla is experiencing continued rapid growth in the energy market, but deliveries remain volatile due to the nature and scale of the projects.

Megapack expands grid capabilities

Tesla is expecting more demand for Megapack in the near future due to the increasing use of AI.

Megapack itself is extremely useful for many industrial use cases, not just AI.

It can effectively double grid capacity by buffering energy usage during off-peak hours

Tesla has many orders in the GWh range already, and is expecting demand in the TWh range in the future.

Tesla is supply constrained on Megapack

Tesla deployed 1 GWh of Powerwall this quarter.

Extremely positive reception from customers; Tesla is supply constrained.

Tesla delivered 1.4TWh of electricity by Supercharging this quarter, with a 26% YoY growth.

Megafactory Shanghai is now online and producing Megapacks, over 100 are on-site and produced, ready to be shipped (not counted this quarter!)

Tesla expects 20GWh of annual production due to the localized supply chain, and up to 40GWh in the future.

Misc.

Tesla is working on getting into India, cars going in are subject to 70% tariffs and 30% luxury tax

Would be an excellent market, aimed at India’s middle class

No discussion about localizing production in India at this time

Giga Berlin and Giga Shanghai likely have enough capacity

Tesla acknowledged that vandalism, unwarranted hostility, and brand image have suffered in several markets, and likely played an impact, but did not have a functional impact on demand

In Q&A, Tesla’s executive team mentioned:

Biggest impact was reduced Model Y production

Tesla remained a best seller in Q1 in multiple regions, and interest remained high

Tesla experienced the highest number of test drives in this quarter, ever

Tesla isn’t immune to macro economic effects

Elon’s Opening Statement

Elon’s opening statement was interesting - and normally we just integrate it right into the rest of the points, but we’ll break it out here because it is fairly important.

Elon acknowledges blowback for his time at DOGE

He believes that his work there is still important

DOGE team has made a lot of progress

Elon wanted to focus on fighting waste and fraud to benefit the US

Most of the work with DOGE is done

Time with DOGE will drop significantly as of next month

Elon will continue to work with DOGE throughout the current term

1-2 days per week as needed

Elon says he will return to focusing on Tesla

DOGE’s mandate ends in July 2026, so Elon will likely have to step away entirely then unless it is extended

This will be a bumpy year for Tesla

Elon is optimistic about the future of the company, but acknowledges 2025 will be challenging, but he doesn’t go into details

Still believes the future of the company is on large-scale autonomy

Both cars and humanoid robots

If Tesla can execute on autonomy, it is well placed for the future

Financial

Tesla saw a 20% YoY decline in total automotive revenues

Partially due to a 15% decline in gross profit, and 9% rise in operating expenses

Tesla saw non-GAAP earnings per share drop to $0.27, from $0.45 in Q1 2024, and $0.60 in Q4 2024.

Tesla attributed the majority of the decline in its vehicle deliveries due to the ramp of the Model Y across all four of its factories globally. The first time any automaker has launched a new model across all factories at the same time.

Tesla’s average selling price (ASP) also declined due to a mix of sales and financing incentives.

Overall, operating income decreased 66% YoY to $0.4B, which is a 2.1% operating margin.

Tesla saw growth in the energy generation and storage sectors (Tesla Energy), and also a higher regulatory credit revenue for this quarter.

Tesla’s continued ramp of the Cybertruck has seen a lower cost associated with its production as of Q1 2024.

Tesla’s CAPEX for 2025 will be in excess of $10 Billion

Tesla is still evaluating what and where to invest.

Listen to Event

You can listen to the entire event below, which starts at the 7 minute, 9 second mark.