Tesla Q&A Recap: Updates on HW3 Upgrade, FSD Unsupervised, HW5 Release, Affordable Model and Much More

In case you missed the Q2 2025 Earnings Call or just want to see all the notes, we’ve got you covered.

We’re covering everything, from Tesla’s X post to their investor’s deck, and more importantly, Tesla’s Q&A session that was held during the call. Surprisingly, Tesla started the webcast perfectly on time once again.

This call was filled with answers to a lot of questions owners have been asking, from the HW3 upgrade to FSD Unsupervised.

Let’s dive in.

FSD Supervised & Unsupervised

Tesla continues to prepare for the broader release of FSD Supervised (HW3) in China, pending regulatory approval

While Tesla has rolled out FSD in China, it’s currently limited to HW4.

Tesla is prepared to launch FSD Supervised in Europe, pending regulatory approval

Still no approval in Europe, sales are expected to improve considerably once FSD is approved

The Netherlands is the primary regulator for Tesla, and Tesla is close to gaining their approval, before it goes to the EU for further approvals

Approvals are on their way, Elon feels confident that it could be as soon as the end of this quarter, if not by the end of the year. As a side note, Tesla recently launched FSD Transfers in Europe.

This quarter, Tesla autonomously delivered a vehicle to a customer with the Model Y driving itself 30 minutes to the customer, including on highways

It took a lot of effort and time to get there, and this is the first

This is the first step for the next phase of deliveries

Teslas will self-deliver in the Bay Area and Austin by the end of this year

Tesla has expanded AI training compute to 67,000 H100 equivalents at Giga Texas’s Cortex

Tesla is still aiming to be cautious, but the service area and number of vehicles will increase extremely rapidly soon

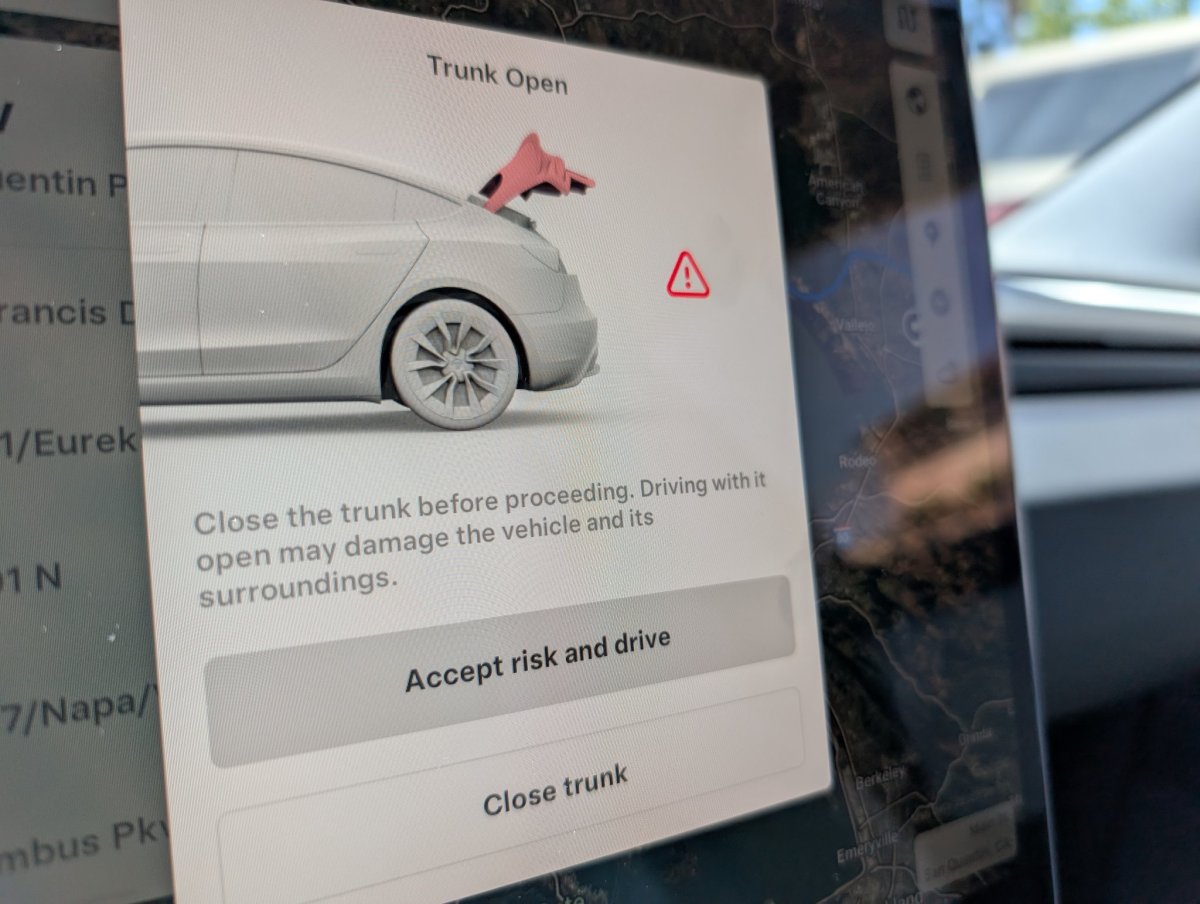

Tesla intends to loosen the Supervision of FSD - within the next several weeks

Requirements for safety cause issues, as people disengage Autopilot to use the controls or use their phone, which is less safe than simply keeping FSD active

Production release of FSD Supervised is several months behind the FSD Robotaxi build (coming soon to customers)

This will be a big step-change improvement in the experience, similar to the experience that some have had in Austin so far

Autonomy is a key driver for vehicle sales

FSD has seen significant improvements; parameter count will increase to roughly 10x

This is a challenge, due to memory bandwidth, but Tesla is confident in this (Ashok said yes in the back). This will clearly be HW4 only, which is already constraining them.

Tesla has seen a bigger uptick in FSD adoption in recent months in North America

Approximately a 25% take rate on FSD since V12. Part of this is likely due to the price decrease

Nearly 50% of Tesla owners who could try FSD have never tried it. Even more have not tried it in a recent version.

Tesla intends to educate and get people to try it more, so they can know about it and its benefits

Robotaxi

Tesla has launched the Robotaxi Network in Austin, and has already expanded the service area once, and will continue to get larger soon. Robotaxi has been great so far, customers love the experience so far they say.

There have been no noticeable safety-critical incidents at this point yet

First expansion is done, more expansions - 10x operation area expansion coming up soon

Tesla will be removing the safety monitor once regulatory approval is received

Tesla intends to expand the service area again within “a couple of weeks.”

Tesla is aiming to gain regulatory permission to launch in the Bay Area, Florida, Arizona, and a number of other places

Tesla intends to aim for access to autonomous ride-hailing for half the population of the US by the end of the year, pending regulatory approval

7,000 miles on the clock already for Robotaxi, only a handful of vehicles are active

An expansion of the area and vehicles is coming soon

Tesla expects it to have a material impact on Tesla’s financials by the end of 2026

Tesla’s validation vehicles aren’t mapping - they are doing rapid-scale testing with new iterations of new FSD builds to ensure they work

This means that Tesla doesn’t need to “map” areas - they just need to test new builds and move on quickly

Personally owned vehicles in the Robotaxi Network

Tesla is still working on getting everything scaled up, which is leaning too far forward

It will happen, but not immediately, likely still sometime next year

Tesla will have some criteria to ensure that personally owned vehicles are eligible to be added to the fleet

Unsupervised FSD

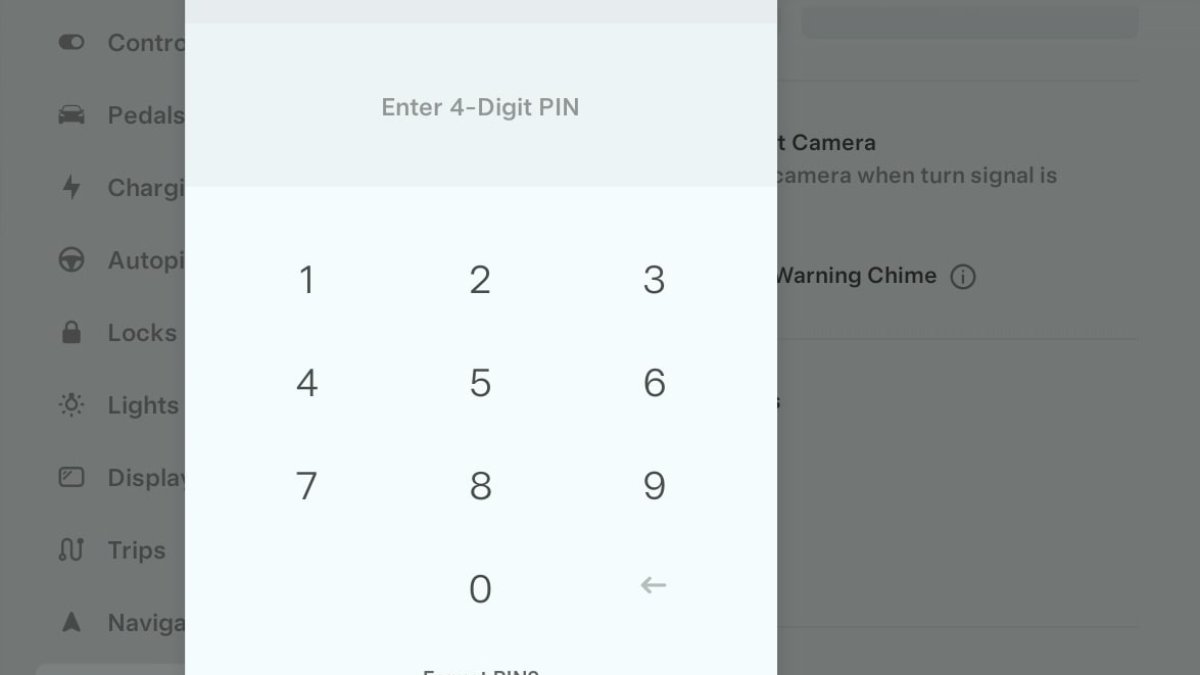

Available for personal use in certain geographies, hopefully by the end of the year

Safety is a concern here, but it will become available for end-users by the end of the year for a number of cities in the US

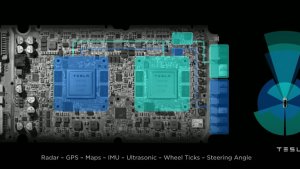

Same hardware in the Robotaxi Model Ys as the hardware that is shipped in customer vehicles today

It is just a software upgrade away

Vehicles

The Model Y is now one of Tesla’s most affordable vehicles with the RWD variant, which starts at $45K USD

Model Y is the best-selling car in Turkey, Switzerland, Austria, and several other nations

Model Y may become the best-selling car for 2025, after barely losing

The new Model Y production ramp was a big step for this Quarter

Affordable Vehicle

Tesla confirms that their plans for a new vehicle that will launch in 2025 remain on track, including initial production of a more affordable model in 1H25

Tesla confirmed that production has started of the lower-cost model in 1H25

The vehicle has been delayed, and the ramp will happen next quarter, slower than expected, due to the cut of the EV credit and the focus on factory rollover to new vehicles

The affordable vehicle will be capable of FSD

Will start in North America, and Tesla is still pushing hard on this

Likely will become available for sale in Q4 2025

Cybercab

Tesla will continue to pursue the unboxed methodology for the production of the Cybercab in 2026

Cybercab isn’t about incredible handling or cornering or anything; it is about building an affordable, safe taxi

It is far more efficient and lighter, designed for a gentle ride

The cost per mile of the Cybercab will be very low, much lower than the existing fleet

AI5 / HW5

Tesla wants to get FSD Unsupervised finished on AI4 before figuring out what to do with HW3 vehicles. The focus is first to get FSD Unsupervised out

This means no hardware upgrade at least until 2026

AI5 is still planned for next year, and AI6 is in the far future

AI5 volume production will be in late 2026 or early 2027

AI5 will be extremely powerful - it is powerful enough that it blows past the export restriction requirements

This may require the chip to be nerfed to be imported to countries like China

Tesla wants its Dojo Supercomputer chip to match the same chip in its vehicles

E.G. 2 AI6 chips in a car, 100s in a Dojo

Dojo 2 will operate at scale by 2026, at around 100,000 H100 equivalents

Optimus

Optimus 3 is coming soon, a big design leap

Optimus 3 sounds like the final production design

Tesla is still retooling and prototyping - final prototypes by the end of 2025

Scale production in 2026, still aiming to build 1 million units per year by 2030-2031.

100,000 units per month, in about 60 months

Elon still sees it as the biggest product ever

Optimus 3 is designed entirely DIY, each part is designed in-house, from motors to power electronics, sensors, mechanical elements, etc.,

Training Optimus to use its limbs and sensors using a neural net is challenging, but the same principles are applied for vehicles

The same AI inference principles for training Tesla uses for vehicle FSD are the same as Optimus FSD

Tesla is still the leader in real-world AI - there is no competitor that’s doing all the same things

Tesla is better than Google or Waymo, or anyone else at real-world AI

Best inference efficiency and intelligence per gigabyte

You can have all the parameters you want, but if the model can’t be run on a real machine, it doesn’t matter

Tesla has the highest intelligence density per hardware

E.G. Grok 4 is immensely intelligent, but it is a terabyte-sized model - it can’t compare to the real-world use of FSD

Optimus V3 will be present for the Shareholder Meeting later in the year

Batteries

Lithium refining and cathode production in North America to begin in 2025, which will move key production onshore to the US

Tesla will begin production of LFP cells within the US by the end of 2025

Not enough people appreciate the scale of battery demand, especially due to grid-scale storage

Energy

Record Powerwall deployments for the fifth consecutive quarter

Tesla Energy’s gross profit is now $846 million, which is increasing quarter-over-quarter and year-over-year

Megapack is now deploying from Mega Shanghai as ramping of the new factory continues

Energy continues to grow really well, despite tariff challenges

The US average usage is 1 TW, but the average is 0.5 TW

Adding batteries could make a massive impact on the US grid

Due to the size and scale of the Energy business, the deliveries tend to differ greatly quarter-over-quarter

Customers for Megapack are willing to accept the tariffs, as the net positive impact of Megapack on their energy grids is massive

Financial

Tesla saw an overall decrease in revenue YoY by 12%, due to:

Decline in vehicle deliveries

Lower regulatory credit revenue

Reduced selling price (ASP) for vehicles

Decline in Energy revenue due to lower ASP

Tesla did see an overall increase in revenue from their Services category of 17% YoY.

Tesla saw an EPS (GAAP) of 0.33, up from 0.12 last quarter, but down from 0.4 last year.

Total automotive revenues shrank by 16% YoY, and total revenue shrank by 12% YoY

Total profit shrank by 15% YoY, but Tesla still posted a free cash flow of $146 million this quarter

New Model Y had a big impact on margins and sales, making a big difference quarter-over-quarter

Test drives in North America are up 20% quarter-over-quarter

Tesla delivered record volumes in South Korea, Malaysia, the Philippines, and Singapore

Tesla launched the Model Y in India, with sales opening in Q2 and deliveries beginning in Q3

Tesla is focused on making prudent investments to expand the company’s vehicle and energy sectors for growth, but the macroeconomic environment may hinder this going forward

Tesla noted that they have sufficient liquidity to fund their product roadmap, expansion, and research

Tesla expects hardware-related profits to be accompanied by an acceleration of AI, software, and fleet-based profits

Real-world AI will make Tesla the most valuable company in the world

Repeal of the IRA EV Credit by end-of-quarter will impact sales

Tesla now intends to roll back some of the incentives it has running due to lack of vehicle supply

Tesla is building vehicles as fast as possible to allow customers to buy vehicles

Tesla may not be able to guarantee delivery of vehicles under the credit

Regulatory credit impact will have an impact, which will lead to lower revenues

Tesla doesn’t plan their business around regulatory credits, but it will have an impact

Cost of tariffs increased around $200m, with about 2/3rd of that in automotive, while the rest is in energy

The biggest impacts will happen in the following quarters

Tesla is working to manage margins and tariff impacts in an uncertain regulatory environment

Tesla expects shifts in demand in Q3 due to the BBB

Tesla will continue to grow R&D income over the next few quarters, even in the face of volatility, but the future is in AI

Other

Tesla added over 2,900 new Supercharger stalls across Q2 2025 - an 18% year-over-year growth of the network

Tesla Diner has been a huge hit, receiving worldwide attention around the world

Sounds like more Diners will be built

Shareholders are welcome to push forward a Shareholder Proposal to have Tesla invest in xAI

New Master Plan coming soon

Will address the transition from pre-autonomy to post-autonomy

Elon is still concerned about the % of ownership, hopes this will be addressed at the next Shareholder Meeting

He hopes to not be in a position to be ousted by activist shareholders

Listen to the Event

You can listen to the entire event below, which starts at the 4 minute, 45 second mark.

![Tesla Hollywood Diner Opens: A Look at the Food, Merch, Features and More [VIDEOS]](https://www.notateslaapp.com/img/containers/article_images/2025/tesla-diner-mosaic.webp/1f15f0d02c11a96d7fa1399f47581304/tesla-diner-mosaic.jpg)