We take a look at the new EV tax credit and which Teslas qualify

The Inflation Reduction Act (a sweeping $750 billion health care, tax and climate bill) was signed into law by President Joe Biden.

Included in the package are some incentives that will make buying electric cars in the US more affordable. The caveat is some of the most popular EVs being sold won’t see any difference.

A tax credit of up to $7,500 will be offered to purchasers of new all-electric vehicles and hybrid plug-in vehicles through 2032. For used versions of these vehicles, the plan would also establish a supplementary tax credit worth a maximum of $4,000.

However, the legislation also introduces additional restrictions on who can be eligible for the credit and which vehicles are eligible for it.

For brand-new cars, the manufacturer's suggested retail price for sedans must be less than $55,000 in order to qualify for the tax credit. For SUVs, trucks and vans, the maximum price would be $80,000.

That price cap effectively leaves out the Tesla Model X and Model S, which start at over $100,000, alongside other premium vehicles like the Mercedes EQS, Porsche Taycan, and GMC Hummer. Some of the more expensive configurations of the Tesla Model 3 won't qualify either.

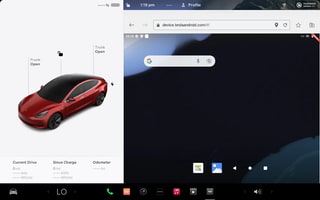

Which Tesla Models Qualify

The only Model 3 that would currently qualify is the entry-level, rear-wheel drive model, which costs around $47,000. This model would be able to take full advantage of the federal tax credit.

Tesla recently discontinued orders for the all-wheel drive Model 3 Long Range model, which could have made the $55,000 cutoff if it received a small price reduction. It'll be interesting to see if Tesla begins to offer that model again in the near future.

The Model 3 rear-wheel drive is the only Tesla that is currently sold for under $55,000. Luckily Tesla's Model Y vehicles are classified as SUVs and will also classify under the truck, vans and SUV portion of the tax credit.

Since SUVs can cost up to $80,000 USD and still qualify for the full tax credit, both Model Ys will qualify as well, including the Performance model which currently comes in at just under $70,000.

| Model | Price | Qualifies |

|---|---|---|

| Model 3 RWD | $46,990 | |

| Model 3 Performance | $62,990 | |

| Model Y Long Range (AWD) | $65,990 | |

| Model Y Performance | $69,990 | |

| Model S | $104,990 | |

| Model S Plaid | $135,990 | |

| Model X | $120,990 | |

| Model X Plaid | $138,990 |

This is significant, given that the Model Y and Model 3 are currently the most popular EVs in the United States. In the first half of 2022, more Model Y and Model 3s were sold in the United States than the combined sales of the next ten most popular EVs.

Used electric vehicles must be at least two model years old in order to qualify. The price cap would be $25,000 and the credit would be limited to the lesser of $4,000 or 30% of the cost of the vehicle.

Other hurdles include a requirement for the final assembly needs to be in North America. That should exclude EVs manufactured by Hyundai Motor, Kia, Audi, and Polestar Automotive. Those firms assemble EVs sold in the U.S. in Asia and Europe.

Additionally, the criteria for the EV purchase credit will alter. For instance, there are specifications for the locations of battery pack assembly and the sourcing of battery components. Those specifications appear to be intended to strengthen the American EV supply chain. Around 2024, these new complexities go into effect. The list of approved automobiles is maintained by the Treasury Department.

It's important to note that the existing $7,500 tax credit, which was established in 2008 and 2009 in order to encourage the adoption of electric cars, included a phase-out provision that would apply if a manufacturer sold 200,000 of the vehicles.

Tesla reached that mark in 2018, and as of right now, its electric vehicles are not eligible for the tax credit. The same applies to General Motors and Toyota (including its Lexus brand). But thanks to the revised bill's removal of the 200,000 sales cap, their electric cars would once again be eligible for the credit.

Additionally, single taxpayers with modified adjusted gross income beyond $150,000 would not be eligible for the credit. This income cap would be $300,000 for married couples filing jointly and $225,000 for single people filing as heads of household.

It might seem like a smart idea to purchase an electric vehicle right now given all the changes to the EV tax credit. However, bear in mind that several benefits, such as the removal of manufacturer limitations and the application of the credit at the time of sale, won't take effect until 2024 or the next year.

Even though this modification to the tax incentives will make the already difficult to navigate EV market much more complicated in the immediate term, in the long term it will be great news for customers, especially middle-class mainstream consumers who later on can purchase more affordable EVs.

![Tesla Adds Third-Party Charge Cable Release Shortcut in Update 2025.20 [VIDEO]](https://www.notateslaapp.com/img/containers/article_images/2021/ccs-adapter.jpg/596b5f1e1d3797f6d2e2667c8af972f7/ccs-adapter.jpg)

_300w.png)