FSD Beta numbers and everything else revealed at Tesla's Q2 earnings call

Yesterday Tesla held its second quarter earnings call. Although Elon Musk has previously said he wouldn't be on earnings calls in the future, he did make this one.

As with previous earnings calls, plenty of data and statistics were revealed relating to production, future products, and FSD Beta.

Below is a recap of the entire event, including the Q&A session. The recap was originally posted to dburkland.com.

You can also listen to the earnings call below. The call begins at the 11 minute mark.

Opening remarks from Elon Musk

- Unique quarter for Tesla due to Shanghai shutdown

- Production records achieved in Fremont & Shanghai

- Set up nicely for record breaking 2nd half of 2022

- Past years have thrown several force majeure at Tesla yet the team continues to overcome

- Giga Berlin Production Ramp continues with 1000 cars / week in June, Giga Austin to follow with the same number in the next few months

- Still making cars w/ 2170 cells in parallel and important to note they aren’t dependent on 4680s and will still hit their production numbers

- FSD Beta deployed to over 100,000 owners

- 5-6 years ago they set out to be the best manufacturer in the world

- Pro-manufacturing mindset has given them a competitive edge

- Currently make the largest castings in the world

- As a result of improved manufacturing processes in Berlin & Texas, Tesla has reduced body

welding robot count by 70% per unit of capacity

- Body shop is roughly 3x smaller as it would be otherwise

- New vehicle bodies are lighter, cheaper, and quieter thanks to reduction in NVH

- Another level of simplicity and improvements are coming with Cybertruck (as well as future products coming down the road)

- Intelligent seat belt tensioning based on vision system recently released, first in the industry to

do this

- Can also adjust the airbag deployment as well

- Delivered via OTA update

- Will have profound impact on passenger safety

- Compatible for all HW3-equipped Teslas

- Cybertruck

- Production still expected to start middle of 2023

- “Best product ever” -Elon

- FSD Beta

- Planned to be released to all North American customers by end of 2022

- FSD will then be released to other geos such as Asia and EU soon after pending regulatory approval

Opening remarks from Zach Kirkhorn

- Made substantial progress in almost every area of the business

- New production records reached in existing factories and new ones actively ramping

- Highest solar production volumes in years

- Temporary shutdown had noticeable impact to vehicle margin

- Factory ramping also associated with negative impact on vehicle margin

- Inflation, commodities, and logistics continue to be headwinds

- Resource constrained on Powerwall and Megapack which should be resolved in the 2nd half of 2022

- Austin & Berlin operating costs are going down as production ramps up

- Tesla sold 75% of Bitcoin holdings

- They did so as they were uncertain when COVID lockdowns in China would end

- As a result they wanted to maximize cash position

- They are still interested in Bitcoin and have not yet sold any Dogecoin

- Highest operating margins ever at 14.6%

- Still targeting 50% of growth and still within reach

Q&A

- Chinese EV Manufacturers & Software Innovation

- Elon believes Tesla China is the best EV manufacturer in China

- Chinese car companies will be a force to be reckoned with going forward

- Tesla has respect for Chinese automakers but believes they have whats necessary to compete

- Unified Vector Space

- Unified Vector Space would be if instead of knitting together dynamic & static objects w/ C++ you knit them together at the NN level (meaning you no longer need to reconcile them in C++ heuristics)

- Architecturally better way

- Slight improvement in efficiency of FSD stack and something they want to get to

- Nirvana situation would be to have surround video auto labeling for all static & dynamic objects as well as surround video inference w/ spacial memory

- Elon believes they have a unified vector space by the end of 2022

- Elon is also very confident that Tesla will improve the frame rate as they delete legacy NNs and further optimize the FSD software stack

- The goal is to get FSD Beta to operate at 36fps for all 8 cameras compared to the current 24 frames which will reduce latency when reacting to a dynamic environment

- Inflation & Future Price Reductions

- They do not control so therefore Elon says take w/ grain salt but thinks inflation to decrease by end of 2022

- Carbon, steel, aluminum, etc are trending down in cost which should see impact later in 2022, early 2023

- Processing of lithium is insanely costly

- Elon again encouraging entrepreneurs to enter the lithium business as there are, “software margins”

- “License to print money” -Elon

- Bitcoin

- Cryptocurrency is not something Tesla thinks about a lot according to Elon

- Main goal is production and addressing climate change by making sustainable energy & transport a reality

- 4680s

- Structural pack is a monumental step forward from a physics perspective and is the way to go

- Gained perspective through entering production w/ structural pack Teslas which proved their hypotheses

- Cost improvements are thanks to solving technical issues and scale

- They have saved 4-5kg in mass from the early cast Model Y underbodies since their initial production

- Plan is to reduce mass of castings and to include more parts (and to adapt vehicle to work better with castings)

- Cybertruck will be another big step in this area

- Making progress on 4680 production ramp but continuing to leverage supplier cells (2170s) to ramp Giga Berlin & Texas

- Total production ramp of 4680 packs to 1000 per week by end of the year (preferably earlier)

- Q2 @ Kato fully automated powder conveyance for the dry anode electrode tool there unlocking major improvements in production & yields too

- Production as a result has increased 35% MoM since March and yields throughout factory are already at targets or trending towards them

- Took learnings from Fremont cell & pack lines and built optimized lines in Giga Berlin & Texas

- Cell design was revved to unlock higher performance and manufacturing simplicity

- Lines were fully integrated and insourced additional content

- As a result new challenges for ramping in Giga Berlin & Texas

- Last quarter cell equipment was fully installed at Giga Texas and they have since produced their first commissioning car sets of 4680s cells

- The target for Texas is to begin mass producing 4680 cells in Q3 2022 with the goal of being able to exceed the weekly cell production capacity of the Kato battery plant by end of 2022

- Priority with 4680s initially is simplicity and scale, Tesla was not aiming to include all of the bells & whistles right off the bat

- As manufacturing goals are achieved they plan to layer in new material technologies into their structural packs (and increase range as well)

- Currently in regards to 4680s Tesla’s main focus is to remove low hanging issues that would prevent further production ramp

- Dry electrode anode & cathode are included in the current 4680 process which makes things harder to ramp (yet they continue to achieve success here)

- Once mass production achieved they plan to quickly iterate w/ an increase in energy density and overall performance soon thereafter

- Tesla cell production will continue to compliment production volumes from suppliers

- Fundamental rate limiter for transition to sustainable energy is rate of li-ion battery pack

production

- Not due to scarcity of raw materials, refining lithium in ultra high purity is quite difficult and requires massive amounts of machinery

- Super difficult to create anode and cathode

- Elon believes 2/3 of batteries in the future will be iron phosphate, maybe some with manganese

- Tesla is actively working with suppliers to ramp as quick as possible

- Tesla is taking action by building their own Cathode plant at Giga Texas as well as taking the plunge into lithium refinement

- FSD Development Progress & Andrej Departure

- While Andrej Karpathy will be missed (recent departure), Elon remains very bullish on current team of 120 people in software / AI group and believes that they will solve FSD by end of 2022

- No major setbacks or delays in FSD timeline should occur as a result of Andrej’s departure

- Elon believes they will raise FSD price just before they go to wide beta (targeted for end of 2022)

- Value of FSD is extremely high and not well understood by most people, Elon thinks its ridiculously cheap if promises of performance materialize

- Semiconductor Supply Chain Constraints

- Tesla procures about 1600 unique pieces of silicon from 43 different companies

- Supply chains are more stable w/ latest generation of chips

- Chips from the analog & mixed signaling space still remain a challenge from a supply chain perspective

- Supply chain line of sight continues to match planned outputs for both factories (no constraints)

- Long term contracts already in place for key battery materials and so there are no concerns about future constraints

- Tesla does not plan to manufacture their own chips however they continue to work with suppliers to ensure future product goals are achieved

- Chip shortage forced Teslas to delete redundant chips and update software accordingly (big positive in hindsight)

- Cybertruck

- Deliveries to begin by the middle of 2023

- Vehicle Demand

- Vehicle demand not an issue for Tesla for the foreseeable future

- No sizable macro impact on demand

- Difference between value in money and affordability and why you can’t just keep increasing prices

- Elon feels that they have raised prices to “frankly embarrassing levels”

- Supply chain and inflation are main culprits for price increases

- Elon is hopeful Tesla can reduce prices soon

- Elon thinks its achievable to produce 40,000 vehicles per week by end of 2022

- Teslas has already produced 30,000 vehicles per week many times, 40,000 vehicles per week is definitely in reach

- Plan is to get Giga Berlin & Texas to ramp to 5,000 vehicles per week by end of 2022 and 10,000 vehicles per week by end of 2023

- Elon reaffirms that Tesla does not have a demand problem but instead a production problem

- Elon’s Role At Tesla

- If there is only good news Elon won’t plan to join the future earnings calls

- Elon is committed to working at Tesla as long as he can continue to help advance the company

- AI

- Elon didn’t want to steal thunder from AI day so he will save the news / updates regarding Dojo & Optimus for then

You can follow Dan Burkland on Twitter at @DBurkland.

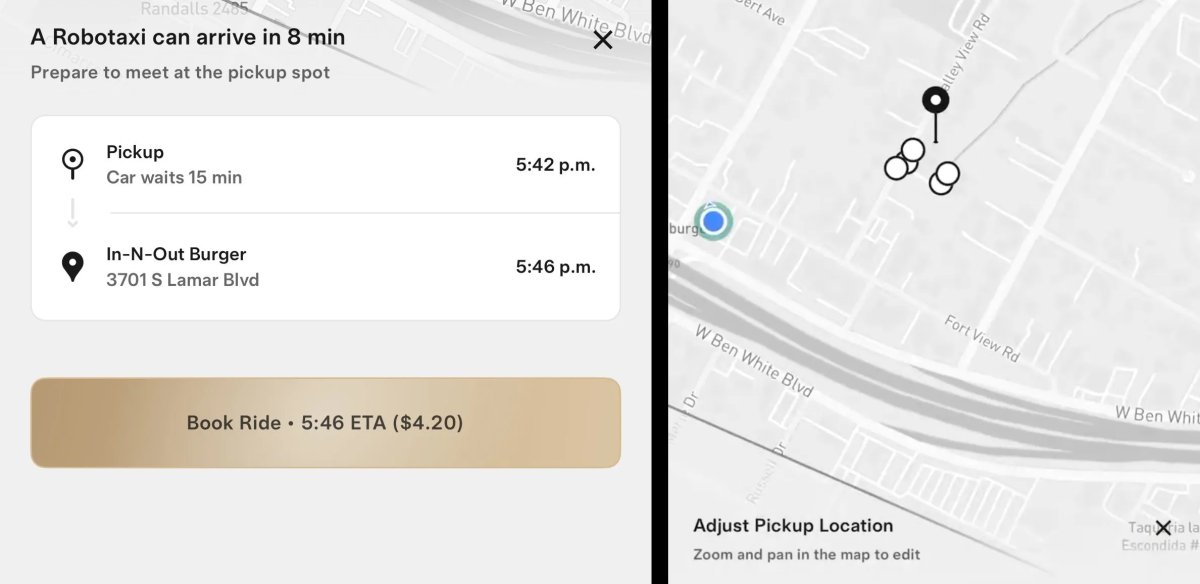

![Tesla Updates Robotaxi App: Adds Adjustable Pick Up Locations, Shows Wait Time and More [VIDEO]](https://www.notateslaapp.com/img/containers/article_images/tesla-app/robotaxi-app/25-7-0/robotaxi-app-25.7.0.webp/4ac9ed40be870cfcf6e851fce21c43b9/robotaxi-app-25.7.0.jpg)