Is Tesla’s Future as a Car Company, or a Services Company?

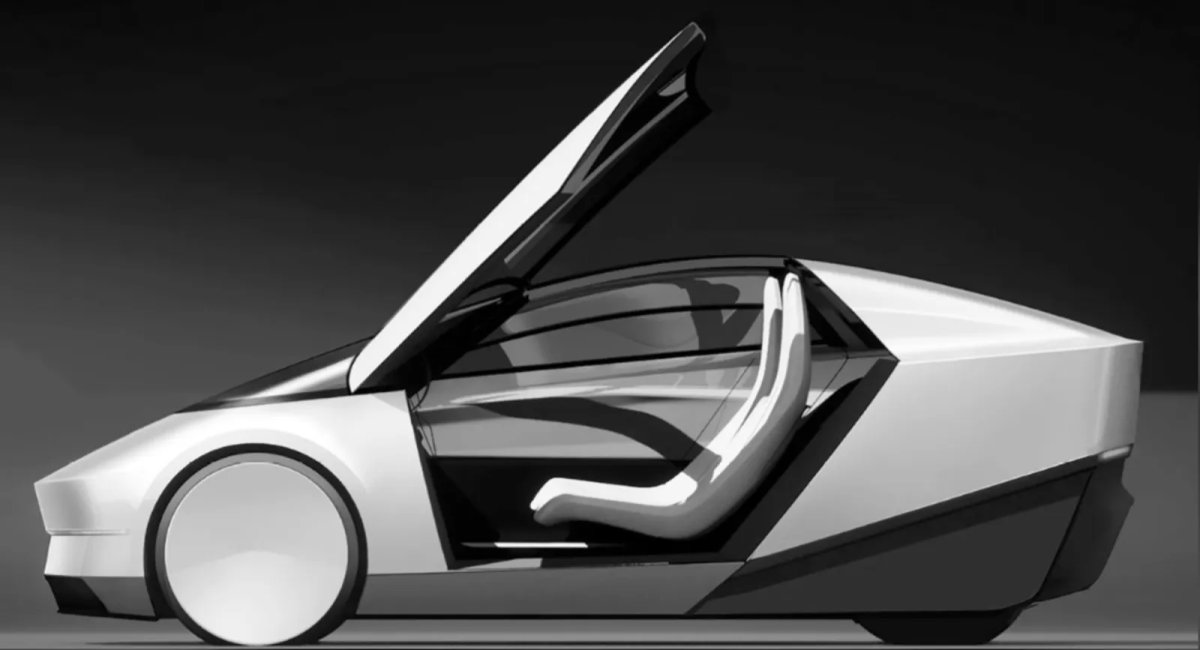

With Tesla’s highly anticipated Robotaxi event just a couple of months away on 8/8, and the Robotaxi itself expected to come to market in 2025 or 2026, the question arises: what is Tesla’s future direction?

Will they continue to produce cutting-edge cars, or will they pivot toward a future where car ownership may no longer make sense?

Advantages of Robotaxi

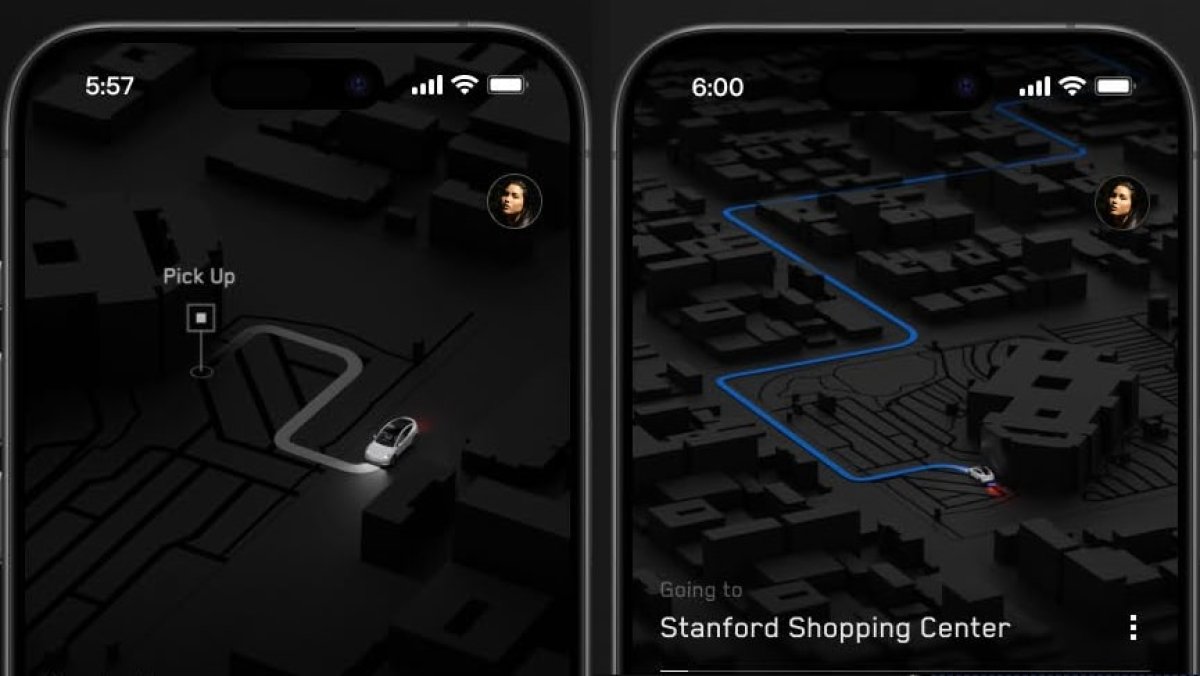

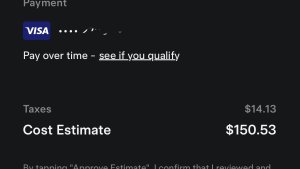

One of Tesla’s upcoming focuses is bringing the price per mile for its Robotaxi network down to one that rivals bus tickets in major cities. Achieving this is quite an engineering and software feat and something that could still be years away.

But what about the Robotaxi itself? Will the advent of cheap, quickly available robotic taxis in cities and suburbs drive away car ownership in urbanized areas?

The potential for Tesla’s Robotaxi service to transform what we currently know as urban mobility is immense. By offering a cost-effective, convenient, and eco-friendly alternative to traditional car ownership, Tesla could change how people navigate cities. The allure of summoning a cheap, quick, and clean Robotaxi could reduce car ownership in cities, alleviate traffic congestion, reduce pollution, and ease parking issues in urban areas.

Moreover, if Tesla succeeds in reducing the price per mile to be competitive with, or even cheaper than mass transit options, the financial incentive to abandon car ownership could become even stronger. For many urbanites, the expenses associated with car ownership – such as insurance, parking, maintenance, charging or fueling costs, and the upfront purchase – can be prohibitive. Robotaxis could tip the balance by providing a seamless, on-demand transportation solution without these additional expenses.

Trust in Robotaxis

However, there are significant obstacles between Tesla and its rosy Robotaxi future. Regulatory and societal hurdles loom ahead on the horizon. From a regulatory perspective, getting Robotaxi services approved will be a major challenge, as Tesla’s autonomous competitors have found themselves operating in regulatory grey zones. Governments will need to develop new frameworks to accommodate and oversee the deployment of autonomous vehicles, ensuring they meet safety and operational standards.

Societally, people will need to adapt to the idea of letting a computer drive them around. This transition can be challenging; even Tesla has found it difficult to convert those offered the FSD V12 trial into paying subscribers. Building trust in autonomous vehicle technology is crucial for the mass adoption of Robotaxi services. Outside of diehard fans and tech enthusiasts, the general public will need to be convinced of the safety and reliability of autonomous vehicles.

Ensuring that Tesla’s reputation for safe vehicles transfers to Robotaxi and FSD will be essential. Tesla must demonstrate the consistent safety and reliability of its Robotaxis to gain this trust.

Reducing Parking & Increasing Drop Off Zones

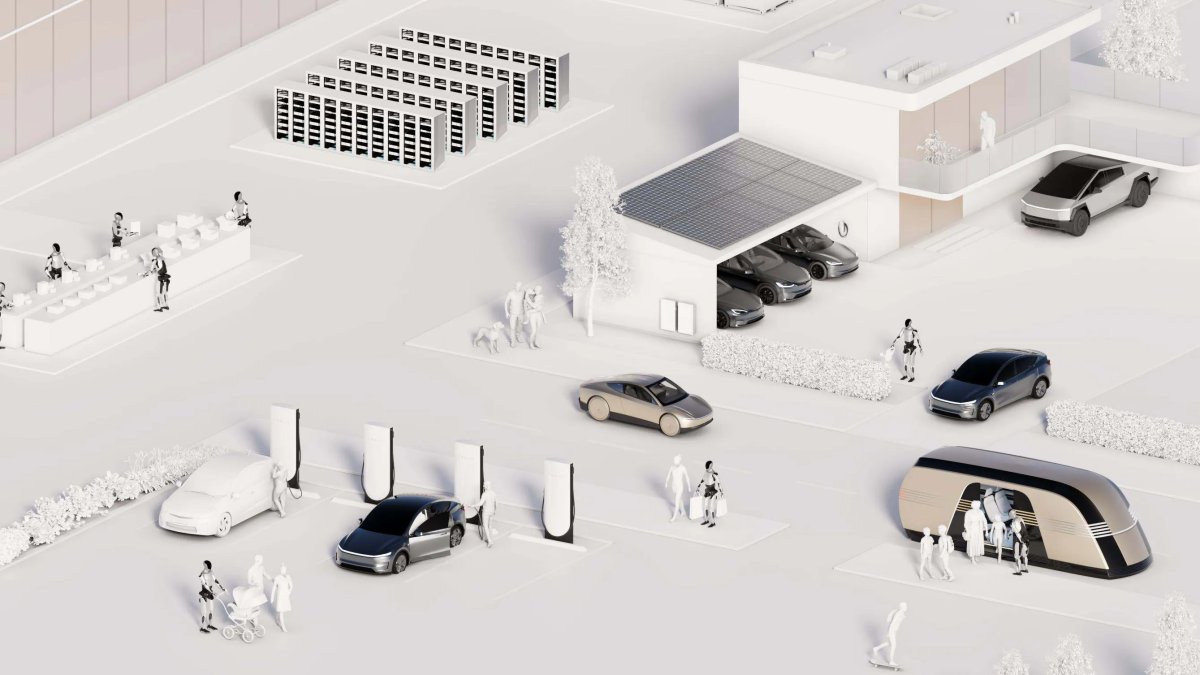

Moreover, the presence and availability of Robotaxis required to displace car ownership in urban centers will necessitate substantial infrastructure investment and acceptance by local governments. Tesla has already deployed an impressive Supercharger network, but the scale required for a fully operational Robotaxi network is much larger. This will mean developing parking garages and charging stations in urban centers, located in centralized areas to ensure ease of access for Robotaxis.

Additionally, integrating Robotaxis into the existing urban fabric will require collaboration with city planners and local authorities. They will need to address concerns about traffic flow, designated pickup and drop-off points, and the overall impact on public transportation systems. The seamless integration of Robotaxis into cityscapes will be critical for their success.

In short, while the promise of Tesla’s Robotaxi network is transformative, achieving this vision will require overcoming significant technical, regulatory, and societal challenges. If Tesla can navigate these obstacles, the benefits of a cost-effective, convenient, and eco-friendly transportation alternative could revolutionize urban mobility, reduce car ownership, and contribute to a more sustainable future.

Tesla as a Car Company

Today, Tesla is still fundamentally a car company. It produces five different consumer vehicles: the Model S, Model 3, Model X, Model Y, and the Cybertruck. Of these, the Model Y achieved remarkable success in 2023, becoming the best-selling vehicle in the world, a significant milestone for an electric vehicle (EV). This success underscores Tesla’s engineering and design prowess, demonstrating its ability to create vehicles that appeal to everyday consumers.

Tesla’s focus on innovation and pushing the boundaries has set it apart in the automotive industry. The company revolutionized car manufacturing with its Gigacasting process, which allows large sections of the vehicle to be made from single pieces of cast aluminum. This innovation reduces complexity, increases production efficiency, and lowers costs. Tesla continues to innovate with its Unboxed vehicle assembly process, further streamlining production. Tesla’s vertically integrated approach is unique in the industry, minimizing reliance on third-party suppliers for vehicle subcomponents. This strategy enhances quality control and allows for faster implementation of new technologies. The Gigafactory model, established by Tesla, plays a crucial role in this approach. Located in the United States, China, Germany, and soon in Mexico, these Gigafactories are not just manufacturing hubs; they are centers of innovation. They serve as test beds for updated production processes and vehicle designs and are sites for subcomponent and battery assembly.

Beyond their manufacturing capabilities, each Tesla vehicle is an engineering marvel. Tesla’s cars consistently score some of the highest ratings in safety tests, reflecting the company’s commitment to building safe vehicles. Their performance is equally impressive; for example, the updated Model 3 Performance boasts an impressive 0-60 mph acceleration time. Tesla also continues to push the envelope with forthcoming models, such as the eagerly anticipated updated Roadster, which promises to deliver unparalleled performance.

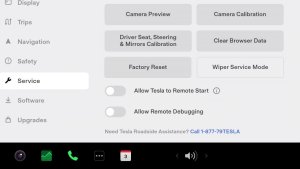

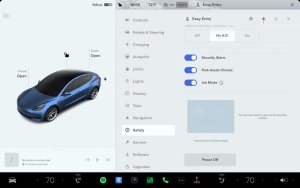

Tesla has set industry standards in several key areas, including over-the-air updates, battery performance, acceleration, range, and user experience. The ability to receive software updates remotely keeps Tesla vehicles current and continuously enhances the user experience. The company leads in battery technology, offering some of the best range and performance metrics in the industry. Tesla’s vehicles are known for their impressive acceleration and long driving ranges, making them not only environmentally friendly but also highly practical and enjoyable to drive. Furthermore, Tesla excels in providing a superior user experience, both in the vehicle and during the shopping process, with minimalist, high-tech interiors and intuitive user interfaces.

Tesla Challenges

However, Tesla faces significant challenges as it continues to grow. The automotive industry is fiercely competitive, with both established automakers and new entrants ramping up their EV offerings. Companies like Ford, General Motors, Volkswagen, and Rivian are investing heavily in electric vehicle technology and infrastructure, intensifying the competition. There are also upcoming Chinese EV companies making strides in both battery tech and additionally, the global transition from internal combustion engine vehicles to electric vehicles is still in its early stages. Broader adoption of EVs depends on various factors, including government policies, the development of charging infrastructure, and changing consumer preferences. Tesla’s ability to influence and adapt to these factors will be crucial for its sustained growth as a car manufacturer.

Wrapping it all together, while Tesla is exploring new avenues as a services company, its core identity as a car manufacturer remains robust. The company’s success with the Model Y and its innovative manufacturing practices highlight its strength in the automotive sector. As Tesla continues to push the boundaries of electric vehicle technology and manufacturing, it solidifies its position as a leader in the industry and sets the stage for future growth.

![Tesla Autonomously Delivers Its First Vehicle to Customer — And It’s More Impressive Than Expected [VIDEO]](https://www.notateslaapp.com/img/containers/article_images/model-y-2025/newmodely_77.jpg/382e0312c769d0bb2e1234f7ac556fad/newmodely_77.jpg)