Everything Tesla Announced During Its Earnings Call - Robotaxi Details, HW3 Support, FSD and More

Did you miss Tesla’s Q3 2024 Earnings Call, or just want to review everything Tesla announced? Either way, we’ve got an outline of everything Tesla announced during the call.

This call was strongly focused on autonomy and revealed a lot more details about Tesla’s plans for its ride sharing service and the Cybercab.

Below is a section-by-section outline of both the actual earnings call and Q&A session and the investor slide deck.

Autonomy and FSD

Tesla is still focusing hard on autonomy

There were 50 autonomous vehicles at the We, Robot event

Carried thousands of people with no incidents or issues

20 were Cybercabs and 30 were regular Model Ys

Cybercab will reach volume production by 2026

Expected to reach 2 million units per year for initial capacity

Tesla could see expanding it to 4 million units per year

There have been significant improvements in FSD year-to-date

FSD launched in the Cybertruck, FSD V12.5 launched most recently

Actually Smart Summon is a taste of Unsupervised FSD

Single Stack for Highway and City, all end-to-end, all neural nets coming soon in V13

100x improvement in miles per intervention between FSD v11.4.9 and FSD v12.5

Tesla expects a 5-6x improvement in miles per intervention between FSD v12.5 and FSD v13

By Q2 next year Tesla expects FSD to have higher miles per critical intervention than the average human’s miles per collision

This is the “safer than a human” mark Tesla is aiming for

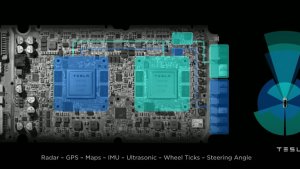

Hardware 4 has made significant strides in helping progress FSD due to the available processing power

Tesla will continue to roll out more 30-day trials with every significant FSD improvement

FSD has seen an increased take-rate after We, Robot

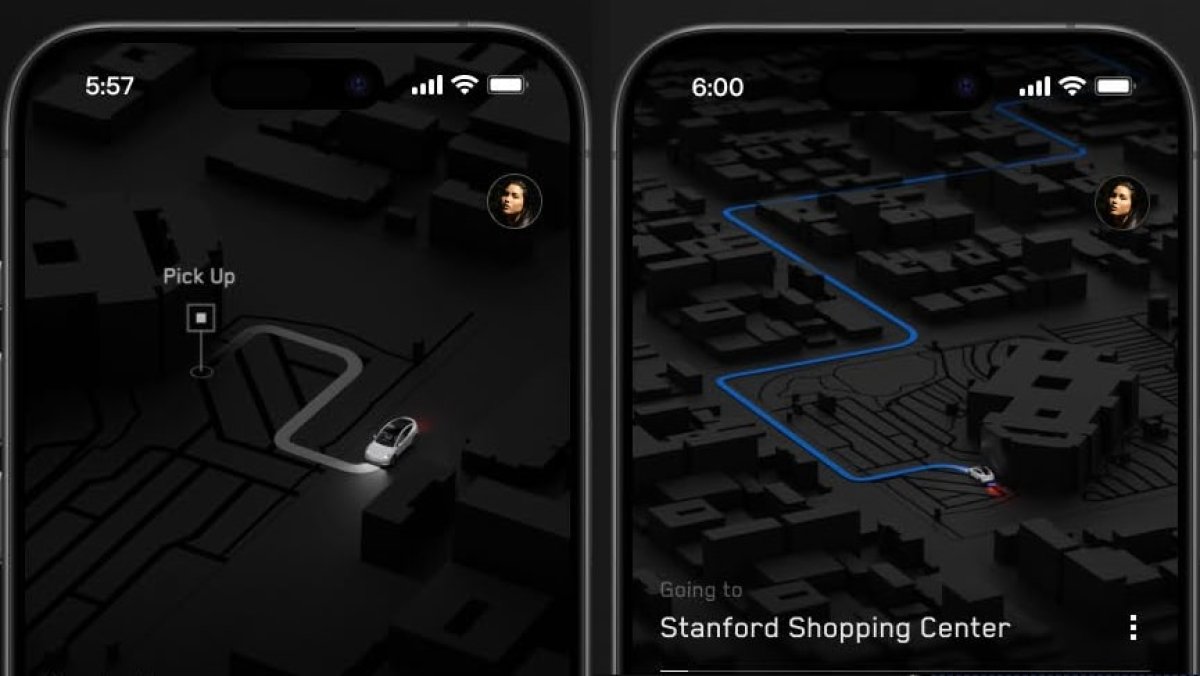

Internal Testing for Robotaxi

Tesla employees in the California Bay Area have already been testing Tesla’s Robotaxi service, which is run with Model Y’s

These vehicles have a safety driver

Tesla is also testing the Robotaxi / ridesharing app internally

Ride Hailing

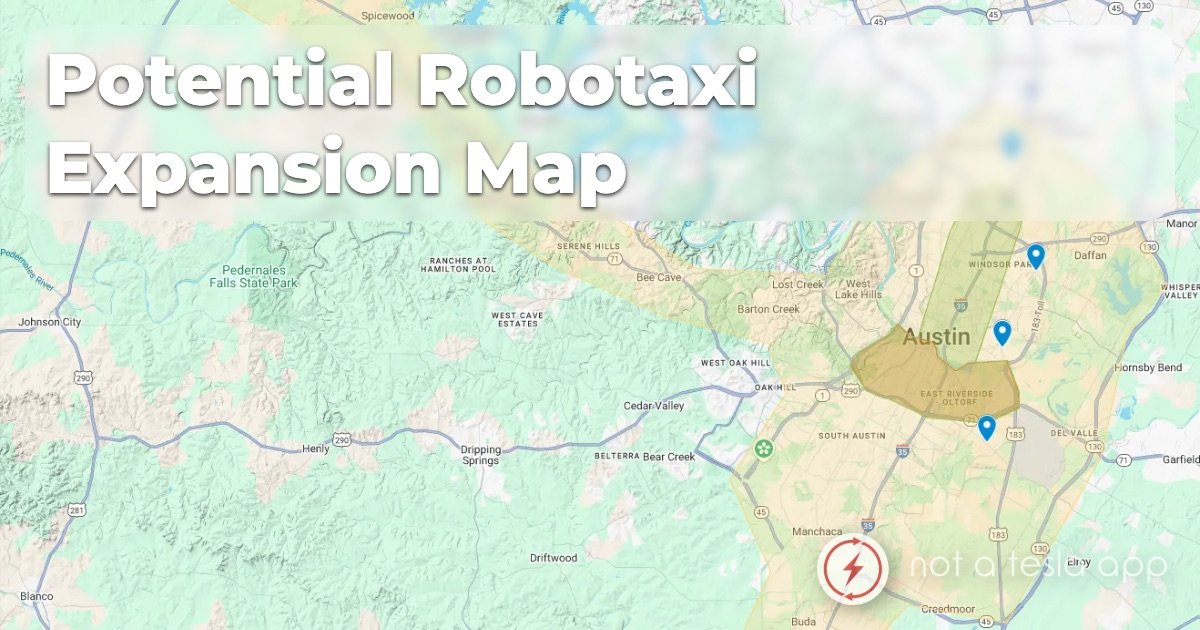

Ride Hailing/Robotaxi network’s initial rollout will begin in Texas and maybe California next year

California’s regulatory approvals will be challenging, and Texas may happen sooner.

California may be delayed to 2026

Other states that follow Texas could come sooner

Driverless Teslas will be offering paid rides sometime next year

Some recently released features were designed for the Robotaxi, but went to every Tesla

Robotaxis will automatically load and adopt your Tesla profile, logging you into media apps, adjusting the vehicle’s climate and seat settings for comfort

Navigation can be done with the phone app, and you can also track progress of Robotaxis on-route

Cybercab, Models S3XY, already meet federal vehicle regulations for autonomy

State vehicle regulations are all over the place, each state has different (or no) process for autonomy

Hardware 3

“Vast Majority” of Tesla’s vehicles on the road today will be capable of autonomy

Tesla will continue to iterate FSD on HW4 first, and then backport to HW3

HW3 does not “fundamentally support” kernel features, and Tesla has to use tricks and additional work to get it to function

Elon admits he is not 100% sure HW3 will be capable of autonomy

If HW3 cannot do the job, Tesla will upgrade HW3 computers for owners who have purchased FSD.

Tesla has previously said multiple times this was not possible, this is big news

Upgrade will only cover the inference computers, not cameras or other parts

Affordable Model - 25K

Tesla’s more affordable model is still on track for the first half of 2025.

It will be built on the same next-gen platform as Cybercab, with an estimated 5.5mi/kWh.

This will be Tesla’s most efficient powertrain.

Tesla will continue to innovate to reduce the cost of its current lineup (S, 3, X, Y, CT).

CT is now profit neutral/approaching profitability

Semi

Semi factory is well under construction, CapEx for the factory is complete

Pilot builds of the updated Semi begin next year

Production ramp begins in 2026

Lots of signaled demand from trucking companies

Tesla is not expecting a demand issue

Cost per mile per ton is far lower than diesel trucks

Companies that don’t adopt Semi won’t be able to keep up

Pepsi’s drivers don’t want to go back to their old vehicles, fight to stay on Tesla’s Semis

“Couple hundred” already deployed this year

Tesla is training the Semi fleet on FSD, will deploy FSD to the Semi when its ready.

Roadster

Roadster is the “cherry on the icing on the cake”

Not a priority for the Tesla mission

Will come after other items that have a bigger impact on the mission (25K Model, etc.,)

Design is close to finalization

Service

Tesla is trying to fix issues upstream - at the factory level - to reduce service wait times

Tesla is looking to establish dedicated service facilities where they have dedicated lanes and technicians for certain specific issues

Throughput of service matters

Tesla, unlike other auto manufacturers, services cars

Normally, car dealers, not manufacturers make money on service

Tesla does not make money on service

Tesla has an incentive to reduce servicing costs as much as possible

Tesla is working on automating vehicle diagnostics and prep work

Vehicle self-diagnoses, information is provided to Tesla

Parts arrive, lift is booked and tools prepared

Vehicle arrives, technician is fully aware of the issue and can immediately fix the problem without wasting time

Already, most of the time Tesla doesn’t need to diagnose the issue, the car diagnoses itself and reports potential problems to Service.

4680 Cell

Tesla has produced the 100 millionth 4680 cell in Q3 2024.

Rapidly becoming the most competitive cell in terms of price

Tesla’s internally produced 4680 will be the most cost-competitive cell in North America

Continued progress on the dry-cathode line and expanding past the initial test batch

Tesla will continue to rely upon external cell providers

Lots of capacity is needed for both vehicles and stationary storage that can’t be achieved internally

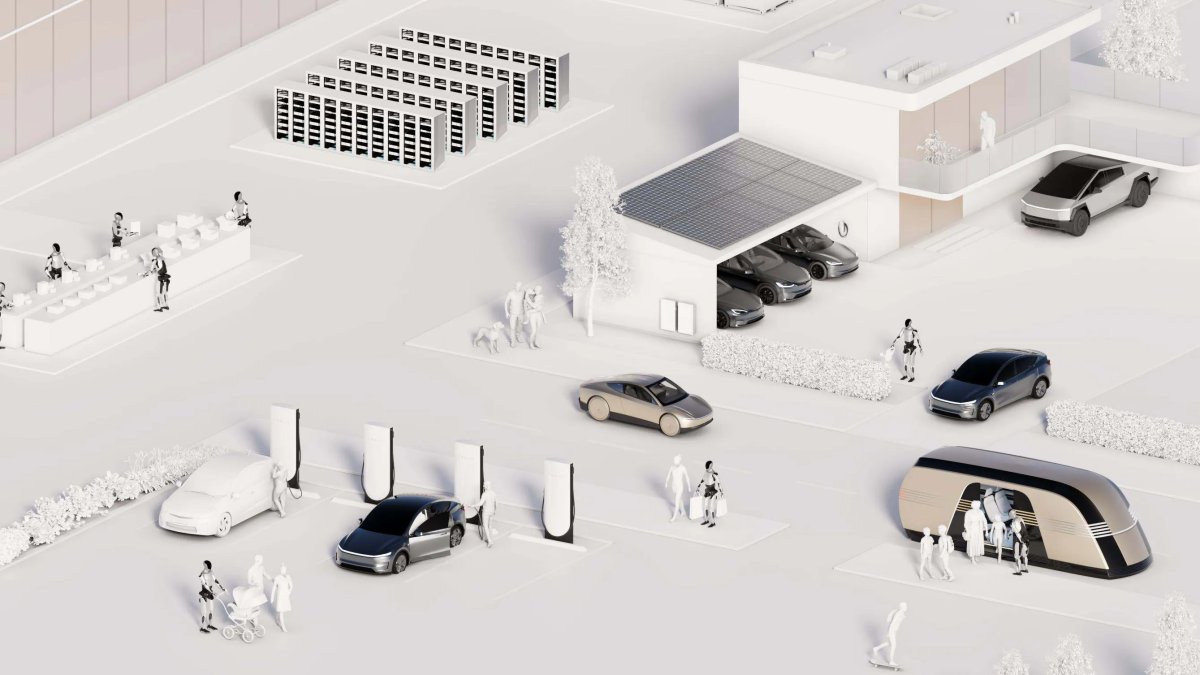

AI and Optimus

AI training capacity is still expanding

Tesla is not compute constrained right now, especially with Cortex coming online

FSD is getting good enough that it is hard to find and figure out issues

Can see 10,000 miles of FSD video and not find an issue in current builds

Tesla is testing both virtually and physically

Real-life physical testing offers additional benefits, interacting with real humans, etc.,

Optimus’ new hand has 22 DoF, and is extremely humanlike

Tesla is likely the only company that can scale humanoid robots

This is likely due to Tesla’s extreme vertical integration, including batteries, actuators, sensors, software, and inference

FSD provides the humanlike brain, while Tesla’s factories can provide volume production capabilities

Grok in Tesla / Infotainment

Tesla will keep expanding what’s available for infotainment, will include AI support

Will also include browser improvements, movies, games, productivity

Energy

Energy is still doing well, lots of space to continuing scaling this business sector

Megafactory Lathrop is doing 200 Megapacks a week, for 40GWh a year

Shanghai will begin doing 20GWh per year, starting Q1 2025

Tesla wants to ship at least 100GWh per year by the end of 2025

Tesla wants to meet the stationary energy demands for a sustainable energy future

This includes the delivery of multiple terawatt hours per year

No material limitations on stationary battery business expansion

No rare materials or complex procedures are involved in the production process

Financial & Deliveries

Tesla has pushed out record deliveries this quarter.

No other EV company or EV section of another automaker is profitable

Tesla’s future is the world’s future - autonomous and fully electric

As Tesla executes on its objectives, Tesla will become the most valuable company in the world.

Tesla has done an excellent job executing in a difficult fiscal and regulatory environment so far

As cyclic fiscal and standing regulatory challenges are overcome, Tesla can continue to expand and grow in value

Automotive revenue grew Quarter over Quarter

Financial incentives have hurt direct profit numbers, but increased overall sales considerably

Tesla will continue to offer compelling financing options, but sparingly

Tesla has a compelling overall package - safety, autonomy, features, total cost of ownership

Tesla acknowledges there is an awareness gap about these items with new and old buyers alike

Tesla has had their vehicle margins grow Quarter over Quarter due to optimizations

Tesla continues to squeeze costs without compromising on the customer experience

Tesla has benefitted from lower freight and duties by delivering vehicles locally in markets where possible

North American vehicles from North America, European vehicles from Giga Berlin, Asian vehicles from China

Decline in interest rates as economy steadies will have a drastic impact on automotive demand

Due to interest rates, people have been holding onto cars longer, especially in North America

This has impacted new vehicle sales, as people are hesitant to spend money

Tesla sees an opportunity to educate and find new buyers in this market sector

Energy saw a decline in Q3, due to cyclic conditions

Projects are long term, and many begin in Q3, while ending in other quarters

Q4 will show growth for Energy

Q3 has been Tesla’s off-quarter for Energy (2021, 2022, 2023)

Tesla’s Q2 restructuring continuing to impact the company, will have no more impacts after Q4

GPU deployments continue, and Tesla will continue making quarterly investments, but sparingly

As it stands, Tesla has more GPU capacity than they can work with now - not compute constrained

Fragmented regulatory landscape will cause issues for the rollout of the Robotaxi Network and Unsupervised FSD

Most automotive companies have not internalized autonomy or EVs, and Tesla is a leader in both sectors

If you’d like to listen to the earnings call, it’s available below.

Plus, Tesla put out a highlight list of some of their biggest achievements for this quarter here on X.

https://x.com/Tesla/status/1849180540408041859

![No Driver Needed: Tesla FSD Stops at Toll, Waits for Driver to Pay and Takes Off Again [VIDEO]](https://www.notateslaapp.com/img/containers/article_images/fsd-beta/fsd-toll-booth.webp/57e008aff60c6c1e998e304eca200cda/fsd-toll-booth.jpg)